Note: This blog article was originally published last April 2024.

Buoyed by increased confidence in a post-pandemic recovery, Philippine real estate has a rosy outlook in 2024. Industry observers all point to a continued market rebound, which is expected to be even stronger this year.

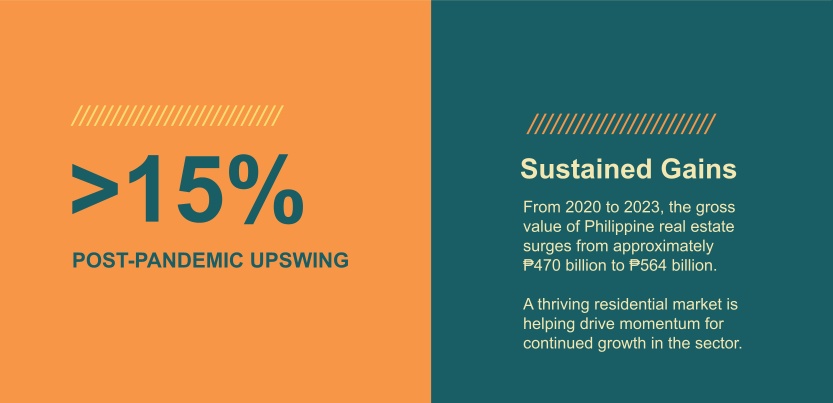

Between 2018 and 2023, the real estate sector generated a gross value of ₱564 billion. That figure is a steady increase from the ₱536 billion recorded in 2022. But it’s even more impressive when you consider the downturn below ₱490 billion in 2020.

A big contributor to growth is the thriving residential market, where major tailwinds are driving up growth expectations. Whether you’re a buyer, serial investor, or existing property owner, there’s something in it for you.

Let’s take a look at the trends that’ll potentially put you in a better position in the near future.

1. More interest in owning a second home

There’s an increasing number of Filipinos looking to own a second home for leisure and/or passive income, according to global real estate consultancy Knight Frank. Areas that are heavily favored for a second home purchase include the perennially popular Tagaytay, Pampanga, and Batangas (particularly Laiya and Nasugbu).

One look at the domestic tourism activity in these regions will tell you why buyers and investors are so keen.

In April 2023, for instance, San Juan in Batangas recorded nearly 690,000 travelers. Tagaytay and Nasugbu followed with just over 436,000 and 268,000 respectively. A multitude of Airbnbs and transient places are spread throughout these places, making them lucrative investments for those planning to engage in short-term rentals.

What it means for buyers:

- The competition for second homes won’t be easy. Buyers should consider working with an agent or local connection who knows where to find the best deals.

- Expect prices to steadily increase as well, as the market gets even more crowded in the coming years.

What it means for sellers:

- As property values appreciate in these areas and local tourism continues to thrive, existing property owners stand to benefit the most.

- Sellers planning a move soon can expect to get a sizable ROI on their properties.

2. Resort-themed developments outside Metro Manila are ramping up

With a burgeoning residential market, developers are setting their sights beyond the Metro. To address the demand for upscale comfort and amenities, developers like Megaworld and Vista Land are creating more resort-themed communities.

Brittany, one of Vista Land’s premium residential real estate arms, is building luxury and leisure developments in the following locales:

- Boracay, Aklan

- Mactan and Talisay, Cebu

- San Juan, La Union

- Puerto Princesa, Palawan

- General Luna, Siargao

Popular tourist spots elsewhere are likely to experience renewed building activity in the coming years

What it means for buyers:

- Whether it’s a house and lot or condominium for sale, buyers will have even more options to choose from in an ever-expanding residential market. Reliable local intel will be crucial in determining which developments to look into.

- Finding a professional agent who can serve as your eyes and ears on the ground will help you focus on investments that align with your overall real estate goals.

3. Metro Manila becomes a hotspot for luxury residential properties

To cap off 2023, Metro Manila recorded the highest growth rate among 46 countries in 2023. This comes at a time when major cities like New York and London are experiencing significant drops in the volume of real estate transactions.

According to Knight Frank, Manila’s luxury residential market led the way with an impressive 21.2% year-on-year increase in Q3 2023 — moving past Dubai (15.9%) and Shanghai (10.4%).

And a few months into 2024, momentum is holding up quite well. Earlier this year, Metro Manila recorded a 26% increase in luxury property prices. Dubai and Bahamas followed with both hitting 15%.

What it means for sellers:

- The trend confirms the continued demand for more spacious and amenity-rich homes, which began during the pandemic

- Sellers and property owners looking to divest in the short-term should plan out quality-of-life upgrades that will boost home value. Promising home improvement ideas range from building a large family den to converting unused rooms and outhouses into home gyms or home offices.

4. The increasing number of high-net-worth clientele

Running parallel to the previous trend is the increasing number of high-net-worth individuals (HNWI) in the country. A HNWI is someone with a net worth of over Php 50 million ($1 million) of liquid assets.

In 2021, the Philippines recorded 13,396 HNWIs. According to projections by Knight Frank, that figure will reach 18,900 by 2025. Additionally, the population of ultra-high-net-worth individuals (UHNWI) — defined as someone with a net worth of over Php 1.4 billion ($30 million) — is projected to increase from 489 to 600 by 2025.

What it means for sellers and property developers:

- Luxury sellers will need to further refine their marketing strategies to target HNWIs and UNWHIs.

- But more importantly, developers also have to make sure there’s enough inventory in the coming years to meet the ongoing surge in the luxury sector.

5. Further integration of real estate and digital technology

COVID forced real estate markets all over the globe to introduce solutions to stay-at-home policies. Although the pandemic is now behind us, many of these innovative workarounds aren’t going anywhere.

From the use of paperless smart contracts to the presentation of virtual tours and 3D modeling in websites, buying and selling real estate has never been this convenient. The rise of property technology companies — be it Lamudi, Dot Property, or Real.ph — will aid the acceleration of widespread adoption of solutions that make it increasingly more efficient to transact.

What it means for buyers:

- Many transactions in the Philippines, most notably in the provinces, continue to make use of traditional methods. However, the use of tech and digital-based solutions will gradually increase alongside a growing young middle class.

- Buyers should keep an open mind to the new ways of accessing real estate information, especially if it helps make the transaction a bit more transparent and efficient.

What it means for sellers and real estate professionals:

- There are now more ways to attract and interact with potential buyers. But with an increasing number of real estate marketing tools at our disposal, creativity and imagination are going to be the real limiting factors.

- Mastery and openness to learn new technology-based tools will be a key driver for success. And if you discover synergies with traditional approaches, all the better.

6. Ongoing infrastructure projects will hasten real estate development

Well before the pandemic, the Philippine government had already allotted a good chunk of the national budget for big infrastructure projects. This summary from the Bangko Sentral ng Pilipinas outlines 194 high-impact infrastructure flagship projects happening in all three major islands. The projects include the following:

- Cebu-Cordova Link Expressway extension project (construction to begin mid 2024)

- North South Commuter Railway Project (bored piling works underway as of Q1 2024)

- LRT-1 Cavite Extension (targeted to open for public use by Q4 2024)

- MRT-7 Project (targeted to open for public use by Q4 2025)

The bulk of the effort, which is composed of 72 projects in Luzon, is intended to help decongest Metro Manila and make its surrounding areas more conducive to long-term investments.

Upon completion, several peripheral regions will become more accessible and become fertile ground for prime developments.

What it means for buyers:

- Buyers planning long-term moves should identify suitable investments as early as possible.

- For the price-conscious, consider seeking out local markets where competition isn’t as stiff. Locations that are still lacking a few modern conveniences (easy access to malls, transport hubs, job centers) may be worth looking into.

7. The recurring theme: Metro decongestion

A number of the major trends we covered in this post all point to a recurring theme: the ongoing decongestion of Metro Manila. Not only is it anticipated to have an impact on property prices across the board, but it’ll potentially pave the way for more affordable rental prices as well — from apartments to condominiums for rent.

But there’s still a long way to go before these effects are felt. In the interim, it’s important to make proactive real estate moves now to take advantage of favorable tailwinds. The best place to start is getting more information about where you intend to buy or sell property.

Start your real estate journey with Real.ph

With Real.ph, you’ll gain access to online listings in some of the hottest markets in the Philippines. Plus, we provide an agent directory and a host of other resources to make your real estate transaction hassle-free.

Best of all, signing up is free! Consider creating a Real account today. If you have questions about the platform, you can get in touch with us through this contact form.